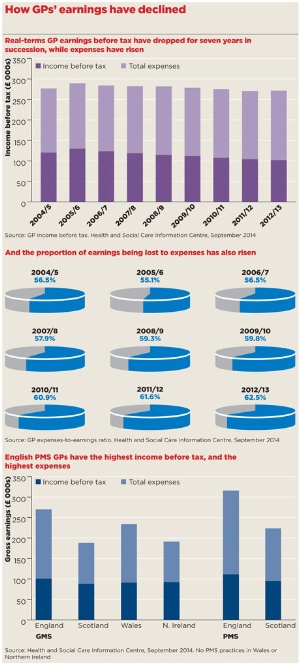

Pre-tax GP income fell to an average of £102,000 in 2012/13 due to soaring expenses levels, the latest official NHS figures show. Earnings dropped by 0.9% compared with 2011/12 – the seventh consecutive annual fall when inflation is taken into account.

Average GP partner income before tax peaked at £129,994 in the UK after the introduction of the 2004 contract, but has since declined by almost 22% in real terms.

The GPC said the figures demonstrated continuing ‘inadequate investment’ in general practice, with rising expenses swallowing up GP funding.

The figures, published last month by the Health and Social Care Information Centre, are the most up-to-date record of gross earnings before pension contributions are deducted.

In the GP funding deal for 2012/13, NHS Employers said GP funding in England, Wales, Scotland and Northern Ireland should be uplifted by 0.5% to help meet increased practice expenses and to ‘put a strong emphasis on improved patient care’.

But the HSCIC figures show income dropped while expenses rose by 2.9%, with the expenses-to-earnings ratio rising by 0.9 percentage points to 62.5%.

English GP partners earned the most at £105,100 before tax, compared with £88,800 in Scotland, £91,000 in Wales and £92,200 in Northern Ireland.

Salaried GP pay was not hit as hard, with average income before tax decreasing by 0.6% between 2011/12 and 2012/13, from £56,800 to £56,400.

GPC chair Dr Chaand Nagpaul said the figures showed GPs had been ‘singularly disadvantaged’ when considered alongside other comparative NHS healthcare staff.

He said: ‘This highlights the Government’s continued inadequate investment in general practice, which is not keeping up with the rising expenses of running a GP practice to meet the increasing volumes of care GPs provide.’